UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Hill-Rom Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | | | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | | | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | | | |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | | | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | | | |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | | | |

| | | | |

| | (4) | | Date Filed: |

| | | | |

| | | | |

| | | | |

HILL-ROM HOLDINGS, INC.

PROXY

STATEMENT

Annual Meeting of Shareholders

March 4, 201515, 2016

10:00 am (Central Time)

Chicago, Illinois

HILL-ROM HOLDINGS, INC.

NOTICE OF ANNUAL SHAREHOLDER MEETING

To Be Held March 4, 201515, 2016

The annual shareholders meeting of Hill-Rom Holdings, Inc., an Indiana corporation, will be held at the following time and location, and for the following purposes:

| Wednesday, March 4, 2015,15, 2016, at 10:00 a.m., Central time. |

| The offices of Hill-Rom Holdings, Inc., 180 North Stetson Avenue, Two Prudential Plaza, Suite 1630, Chicago, Illinois 60601. |

| (1) | To elect nine members to the Board of Directors to serve one-year terms expiring at the 20162017 annual meeting or until their successors are elected and qualified; |

| | (2) | To consider and vote on a non-binding proposal to approve the compensation of Hill-Rom’s executive officers; |

| | (3) | To consider and vote on a non-binding proposal to establish the frequency of the shareholder vote on executive compensation; |

| (4) | To reauthorize the Hill-Rom Holdings, Inc. Short Term Incentive Plan, as it is currently written; |

| (5) | To reauthorize the Hill-Rom Holdings, Inc. Stock Incentive Plan, as it is currently written; |

| (6) | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Hill-Rom Holdings, Inc. for fiscal year 2015;2016; and |

| | (4)(7) | To transact any other items of business that may properly be brought before the meeting and any postponement or adjournment thereof. |

| Only stockholders of record as of the close of business on December 31, 2014January 8, 2016 are entitled to vote at the meeting. Whether or not you plan to attend the meeting, please cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet, by telephone, or via mail, as promptly as possible. |

Your vote is important. Whether or not you plan to attend the meeting, please cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet, by telephone, or via mail, as promptly as possible. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet. We believe it is convenient for our shareholders, while significantly lowering the cost of our annual meeting and conserving natural resources.

| | By Order of the Board of Directors | |

| | | |

| |  | |

| | Susan R. Lichtenstein | |

| Deborah M. Rasin | |

| | Secretary | |

TABLE OF CONTENTS

| EXECUTIVE SUMMARY | 1 |

| | |

| GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 45 |

| | |

| PROPOSALS REQUIRING YOUR VOTE | 89 |

| | |

| Proposal No. 1 – Election of Directors | 89 |

| Proposal No. 2 – Non-Binding Vote on Executive Compensation | 1213 |

| Proposal No. 3 – Non-Binding Vote on Frequency of Shareholder Vote on Executive Compensation | 14 |

| Proposal No. 4 – Reauthorization of the Hill-Rom Holdings, Inc. Short-Term Incentive Compensation Plan | 15 |

| Proposal No. 5 – Reauthorization of the Hill-Rom Holdings, Inc. Stock Incentive Plan | 17 |

| Proposal No. 6 – Ratification of the Appointment of the Independent Registered Public Accounting Firm | 1322 |

| | |

| CORPORATE GOVERNANCE | 1423 |

| | |

| AUDIT COMMITTEE REPORT | 1827 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 1928 |

| | |

| COMPENSATION DISCUSSION AND ANALYSIS | 2231 |

| | |

Compensation and Management Development Committee Report | 2231 |

| Detailed Table of Contents for CD&A | 2231 |

| | |

| COMPENSATION OF NAMED EXECUTIVE OFFICERS | 3447 |

| | |

| DIRECTOR COMPENSATION | 4560 |

| | |

| EQUITY COMPENSATION PLAN INFORMATION | 4762 |

| | |

SECTION 16(A)16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 4863 |

PROXY STATEMENTProxy Statement |

This proxy statement relates to the solicitation by the Board of Directors of Hill-Rom Holdings, Inc. (“Hill-Rom”, the “Company”, “we”, “us” or “our”), of proxies for use at the annual meeting of Hill-Rom’s shareholders to be held at our offices located at 180 North Stetson Avenue, Two Prudential Plaza, Suite 1630,, Chicago, Illinois 60601, on Wednesday, March 4, 2015,15, 2016, at 10:00 a.m., Central time, and at any adjournments of the meeting. This proxy statement and the enclosed form of proxy were mailed initially to shareholders on or about January 22,27, 2016. 2015.

EXECUTIVE SUMMARYExecutive Summary |

This summary highlights selected information in this proxy statement. Please review the entire proxy statement and the Hill-Rom 20142015 Annual Report before voting. This proxy statement and annual report to shareholders are available at www.proxyvote.com.www.proxyvote.com.

Key Fiscal 20142015 Achievements

In fiscal 2014, Hill-Rom executed on a number of key business initiatives by making strategic acquisitions, investing in new products and markets, and leveraging our infrastructure by keeping adjusted SG&A near 30% of revenues, despite a weak capital spending environment in North America and western Europe. Moreover, we returned over $92 million in cash to our stockholders via dividends and repurchases. Specifically, we:2015, Hill-Rom:

| | · | DiversifiedIncreased revenue 18%. |

| · | Grew adjusted EPS by 17% to $2.64. |

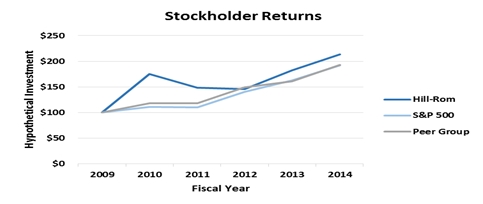

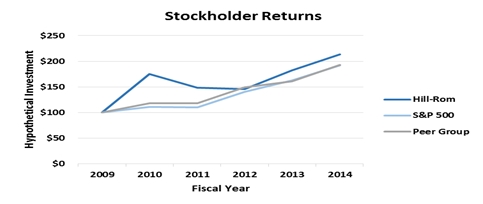

| · | Achieved a total stockholder return of over 27%. Over the last three years, our revenue baseTSR has substantially outpaced both our peer group and expanded our product portfolio through the acquisition of Trumpf Medical, which provides a portfolio of surgical infrastructure solutions, for approximately $250 million. WithS&P 500, as shown by the acquisition of Trumpf, approximately 40% of our revenue will be outside the United States.graph below. |

| | · | Achieved a total stockholder returnCompleted the acquisition of 17.3% during fiscal year 2014.Welch Allyn for approximately $2B. Through the acquisition of Welch Allyn, Hill-Rom expects to play an even greater role in improving patient care globally and achieving greater levels of efficiency and reducing healthcare costs for its customers. Combining Hill-Rom’s leading position in hospitals and operating rooms worldwide with Welch Allyn’s leading position in point of care diagnostics and testing will expand both companies’ ability to help healthcare providers focus on patient care solutions that improve clinical and economic outcomes.

|

| · | Successfully integrated Trumpf Medical, which we acquired in 2014. Trumpf’s portfolio of surgical infrastructure solutions helped the company achieve its high organic growth rate. |

| | · | Commercialized a number of new products, including a new ICU bed frame, the ProgressaTM,Compella™ Bariatric Bed, Hill-Rom’s latest advance in bariatric care, which streamlines workflow, delivers safe patient care and a bed frameenhances patient dignity, along with the LikoGuard™ L/XL Overhead Lift System, which facilitates safe mobilization for the emerging markets called CenturisTM.patients up to 800 pounds/363 kg. We also commercialized significant new productsmade product advances in our Surgical &and Respiratory Care division, including two airway clearance devices, VitalCoughTM and a new MetaNebTMacquiring an early-stage portable therapeutic device that provides chest physiotherapy (CPT), and obtaining exclusive distribution rights to the Thermedx FluidSmart™ System, a newfluid management system used in minimally invasive gynecology, urology and arthroscopy surgical table, the Allen Advance TableTM. procedures. |

| | · | Increased Hill-Rom’s dividend by approximately 10% for the fourthfifth consecutive year. In the last fourfive fiscal years, Hill-Rom has returned over $365$525 million to shareholders by dividends and repurchases. |

Voting Matters and Board Recommendations

| Proposal | Recommendation of the Board | Page References |

To elect nine members to the Board of Directors for one year terms | FOR all nominees | 89 |

To vote on a non-binding proposal to approve the compensation of Hill-Rom’s executive officers | FOR the proposal | 1213 |

To consider and vote on a non-binding proposal to establish the frequency of the shareholder vote on executive compensation | FOR a vote every one year | 14 |

To reauthorize the Hill-Rom Holdings, Inc. Short Term Incentive Plan, as it is currently written | FOR the proposal | 15 |

To reauthorize the Hill-Rom Holdings, Inc. Stock Incentive Plan, as it is currently written | FOR the proposal | 17 |

To ratify the appointment of PricewaterhouseCoopers LLP as Hill-Rom’s independent registered public accounting firm for fiscal year 20152016 | FOR ratification of the appointment | 1322 |

Director | Audit Committee | Nominating/ Corporate Governance Committee | Compensation and CompensationManagement

Development Committee | Mergers and Acquisitions Committee |

| Rolf A. Classon (Board Chair) (I) | | üC | ü | C |

| John J. Greisch | | | | ü |

| William G. Dempsey (I) | | | ü | |

James R. Giertz (I) | ü | | ü | |

| Charles E. Golden (I) | C | ü | | ü |

| William H. Kucheman (I) | ü | | | ü |

| Ronald A. Malone (I) | | ü | C | ü |

| Eduardo R. Menascé (I) | ü | | | |

Stacy Enxing Seng*Seng (I) | | | | |

Joanne Smith, M.D.* (I) | | C | ü | |

(I) Denotes independent director; (C) denotes chair

*Ms. Enxing Seng is a new nominee to the Board; Joanne Smith, M.D., will not stand for reelection.

Additional important information about our annual meeting and voting can be found in the section entitled “General Information About the Annual Meeting and Voting” beginning on page 4.5.

Governance Highlights

Our Board believes that good corporate governance enhances shareholder value. Our governance practices include:

| Governance Practice | For More Information |

| All of our directors, except our CEO, are independent | 1525 |

| We have a non-executive, independent Board chair | 1423 |

Our directors attended on average 99% of Board and their respective committee meetings, and each attended more than 90% of the meetings of the Board and their respective committees | 1524 |

Our directors are elected annually, and we have a resignation policy if a director fails to garner a majority of votes cast | 8, 67, 9 |

| Our independent directors meet regularly in executive session | 1423 |

| We have a fully independent compensation consultant | 46 |

Executive Compensation Highlights

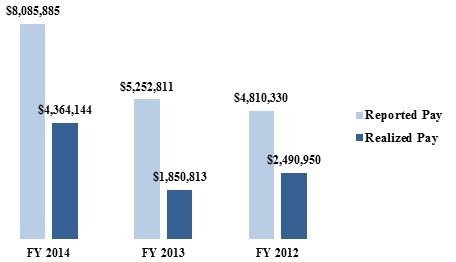

Hill-Rom’s compensation program is designed to align each executive’s compensation with Hill-Rom’s performance and the interests of our shareholders, and to provide the proper incentives to attract, retain and motivate key personnel in a clear, transparent manner. In order to do this, we:

| | · | Generally target the 50th percentile of compensation paid by companies with which we compete for executive talent;talent, and the Committee ultimately considers median pay, recommendations from our CEO, head of HR, internal equity relationships and the advice of the Committee's compensation consultant in determining final pay decisions, |

| | · | Provide an annual cash incentive award based on meaningful company performance metrics such as revenue and adjusted earnings per share, modified for individual performance;performance, and |

| | · | Align long-term equity compensation with our shareholder’sshareholders’ interests by linking realizable pay with stock performance through a combination of performance stock units, restricted stock units, and stock options. |

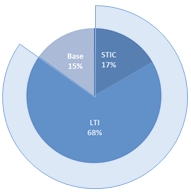

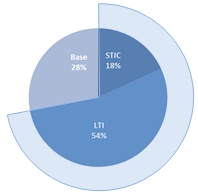

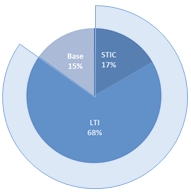

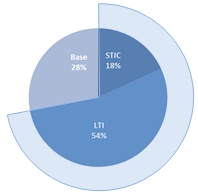

In summary, we compensate our named executive officers as follows:

| Component of Compensation | Form of Compensation |

| Base Salary | Annual Cash Salary |

| Annual Cash Incentive | 162(m) qualified plan, with negative discretion exercised by reference to our company-wide Short-Term Incentive Compensation Plan |

| Long-Term Incentive Compensation | Performance Stock Units (50% of annual grant value) Restricted Stock Units (25% of annual grant value) Stock Options (25% of annual grant value) |

We also adhere to several additional principles regarding executive compensation, which we believe highlight the strength of both our governance and our overall executive compensation program:

| Executive Compensation Principle | For More Information |

We require significant stock ownership by our executive officers, including 6X base salary for our CEO; this was recently increased from 4XCEO | 3042 |

| We have clawback, anti-hedging and anti-pledging policies | 3042 |

| We don’t have any single-trigger change in control agreements | 43 |

| Our executives all have at-will employment agreements | 43 |

| We don’t re-price stock options or buy-back equity grants | |

Our executives all have at-will employment agreements | 3142 |

We don’t have any single-trigger change in control agreements

| 31 |

| We don’t provide gross-ups for perquisites or excise taxes, other than moving expenses | 3143 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTINGGeneral Information About the Meeting and Voting

|

Shareholders holding shares of Hill-Rom common stock as of the close of business on December 31, 2014January 8, 2016 are entitled to vote at the annual meeting. At the close of business on such record date, there were 56,499,59465,301,517 shares of common stock outstanding and entitled to vote at the annual meeting. Common stock is the only class of stock outstanding and entitled to vote. You have one vote for each share of common stock held as of the record date, which may be voted on each proposal presented at the annual meeting.

| 2. | How can I elect to receive my proxy materials electronically? |

If you would like to reduce the costs incurred by us in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically. To sign up for electronic delivery, follow the instructions provided with your proxy materials and on your proxy card or voting instruction card to vote using the Internet, or go to https://enroll1.icsdelivery.com/hrc. When prompted, indicate that you agree to receive or access shareholder communications electronically in the future.

| 3. | Can I vote my shares by filling out and returning the Notice Regarding the Availability of Proxy Materials? |

No. See belowQuestion 6 “How do I vote?” for instructionsmore information on how to vote.

| 4. | How can I access the proxy materials over the Internet? |

You can view the proxy materials for the annual meeting on the Internet at www.proxyvote.com. Please have your 12 digit control number available, which can be found on your Notice Regarding the Availability of Proxy Materials or on your proxy card or voting instruction form. Our proxy materials are also available on our website at http://ir.hill-rom.com.

| 5. | How does the Board recommend that I vote? |

The Board recommends that you votevote:

| | · | FOR each of the nominees for director, |

| | · | FOR the non-binding approval of the compensation of Hill-Rom’s executive officers, |

| · | To hold the non-binding advisory shareholder vote on executive compensation EVERY ONE (1) YEAR, |

| · | FOR the approval of the Hill-Rom Holdings, Inc. Short-Term Incentive Plan, |

| · | FOR the approval of the Hill-Rom Holdings, Inc. Stock Incentive Plan, and |

| | · | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as Hill-Rom’s independent registered public accounting firm. |

You may vote by any of the following methods:

| | · | By Telephone or Internet — You may submit your proxy vote by following the instructions provided in the Notice Regarding the Availability of Proxy Materials, or by following the instructions provided with your proxy materials and on your proxy card or voting instruction form. |

| | · | By Mail — You may submit your proxy vote by mail by signing a proxy card and mailing it in the enclosed envelope if your shares are registered directly in your name or, for shares held beneficially in street name, by following the voting instructions provided by your broker, trustee or nominee, and mailing it in the enclosed envelope.nominee. |

| | · | In Person at the Annual Meeting — You may vote in person at the annual meeting or may be represented by another person at the meeting by executing a proxy designating that person. |

| 7. | If I voted by telephone or Internet and received a proxy card in the mail, do I need to return my proxy card? |

No.

If you are a shareholder of record, you may revoke your proxy at any time before the voting polls are closed at the annual meeting by the following methods:

| · | voting at a later time by telephone or Internet (up to 11:59 p.m. Eastern time on the day before the meeting);, |

| · | writing our Corporate Secretary, Susan R. Lichtenstein, Hill-Rom Holdings, Inc., 1069 State Route 46 East, Batesville, Indiana 47006;47006, or |

| · | giving notice of revocation to the Inspector of Election at the annual meeting. |

If you are a street name shareholder and you voted by proxy, you may later revoke your proxy by informing the holder of record in accordance with that entity’s procedures.

| 9. | What happens if I do not specify a choice for a proposal when returning a proxy? |

If you are a shareholder of record and your proxy card is signed and returned without voting instructions, it will be voted according to the recommendation of the Board of Directors.

If you are a beneficial/street name shareholder and fail to provide voting instructions, your broker, bank or other holder of record is permitted to vote your shares on the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm. However, they may not vote on the election of directors or on the proposal regarding executive compensationother proposals listed herein absent instructions from you. Without your voting instructions on the proposals, a “broker non-vote” will occur with respect to those proposals.

| 10. | How are votes, including broker non-votes and abstentions, counted? |

Votes are counted in accordance with our Amended and Restated Code of By-laws and Indiana law. A broker non-vote or abstention will be counted towards a quorum, but will not be counted in the election of directors or the votes on any of the other proposals.

| 11. | What constitutes a quorum? |

A majority of the outstanding shares of common stock entitled to vote, represented at the meeting in person or by proxy, constitutes a quorum. Broker non-votes and abstentions will be counted as represented at the meeting for purposes of determining whether a quorum is present.

| 12. | What happens if other matters come up at the annual meeting? |

The matters described in the notice of annual meeting are the only matters we know of that will be voted on at the annual meeting. If other matters are properly presented at the annual meeting, the persons named on the proxy card or voting instruction form will vote your shares according to their best judgment.

| 13. | Who will count the votes? |

A representative of Broadridge Financial Solutions, Inc., an independent tabulator appointed by the Board of Directors, will count the votes and act as the Inspector of Election. The Inspector of Election will have the authority to receive, inspect, electronically tally and determine the validity of the proxies received.

| 14. | Who can attend the annual meeting? |

Admission to the annual meeting is limited to shareholders of Hill-Rom, persons holding validly executed proxies from shareholders who held Hill-Rom common stock on December 31, 2014,January 8, 2016, and invited guests of Hill-Rom.

In order to be admitted to the annual meeting in person, you should pre-register by contacting Hill-Rom’s Investor Relations Department at investors@hill-rom.com, or in writing at Investor Relations, Hill-Rom Holdings, Inc., 1069 State Route 46 East, Batesville, IN 47006,180 N. Stetson Avenue, Two Prudential Plaza, Suite 4100, Chicago, Illinois 60601, no later than February 27, 2015.March 7, 2016. Additionally, proof of ownership of Hill-Rom stock must be shown at the door. Failure to pre-register or to provide adequate proof that you were a shareholder on the record date may prevent you from being admitted to the annual meeting. Please read the following rules carefully because they specify the documents that you must bring with you to the annual meeting in order to be admitted.

If you were a record holder of Hill-Rom common stock on December 31, 2014,January 8, 2016, then you must bring a valid government-issued personal identification (such as a driver’s license or passport).

If a broker, bank, trustee or other nominee was the record holder of your shares of Hill-Rom common stock on December 31, 2014,January 8, 2016, then you must bring:

| | · | Valid government-issued personal identification (such as a driver’s license or passport), and |

| | · | Proof that you owned shares of Hill-Rom common stock on December 31, 2014.January 8, 2016. |

If you are a proxy holder for a shareholder of Hill-Rom, then you must bring:

| · | The validly executed proxy naming you as the proxy holder, signed by a shareholder of Hill-Rom who owned shares of Hill-Rom common stock on December 31, 2014, andJanuary 8, 2016, |

| · | Valid government-issued personal identification (such as a driver’s license or passport), and |

| · | Proof of the shareholder’s ownership of shares of Hill-Rom common stock on December 31, 2014.January 8, 2016. |

| 15. | How many votes must each proposal receive to be adopted? |

Directors are elected by a plurality of the votes cast by shareholders entitled to vote, which means that nominees who receive the greatest number of votes will be elected even if such amount is less than a majority of the votes cast. However, our Corporate Governance Standards provide that, prior to nomination, director nominees shall submit a letter of resignation that is effective in the event such director receives a greater number of votes “withheld” from his or her election than votes “for” such election. The Board is required to accept the resignation unless the Board determines that accepting such resignation would not be in the best interests of Hill-Rom and its shareholders.

The non-binding proposal to approve the compensation of our Named Executive Officers and the proposalproposals to approve our Stock Incentive Plan, our Short Term Incentive Plan, and to ratify the appointment of the independent registered public accounting firm will be approved if the votes cast favoring the action exceed the votes cast opposing the action. The non-binding vote on the frequency of the shareholder vote on executive compensation will be determined by plurality vote, with the frequency receiving the greatest number of votes being the frequency approved by the shareholders.

| 16. | Who pays for the proxy solicitation related to the annual meeting? |

We do. In addition to sending you or making available to you these materials, some of our directors and officers, as well as management and non-management employees, may contact you by telephone, mail, e-mail or in person. You may also be solicited by means of press releases issued by Hill-Rom, postings on our website, and advertisements in periodicals. None of our officers or employees will receive any extra compensation for soliciting you. We have retained Innisfree M&A Incorporated to assist us in soliciting your proxy for an estimated fee of $8,000 plus reasonable out-of-pocket expenses. We will also reimburse banks, nominees, fiduciaries, brokers and other custodians for their costs of sending the Notice Regarding the Availability of Proxy Materials or proxy materials to the beneficial owners of Hill-Rom common stock.

| 17. | If I want to submit a shareholder proposal for the 20162017 annual meeting, when is it due and how do I submit it? |

In order for shareholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 to be presented at our 20162017 annual meeting of shareholders and included in our proxy statement and form of proxy relating to that meeting, such proposals must be submitted to the Secretary of Hill-Rom at our principalregistered offices in Batesville, Indiana no later than October 14, 2015,September 29, 2016, which is 120 days prior to the calendar anniversary of the mailing date of this proxy statement.

In addition, our Amended and Restated Code of By-laws provides that for business to be brought before a shareholders’ meeting by a shareholder or for nominations to the Board of Directors to be made by a shareholder for consideration at a shareholders’ meeting, notice thereof must be received by the Secretary of Hill-Rom at our principalregistered offices not later than 100 days prior to the anniversary of the immediately preceding annual meeting, or not later than November 25, 2015December 5, 2016 for the 20162017 annual meeting of shareholders. The notice must also provide certain information set forth in the Amended and Restated Code of By-laws.

| 18. | How can I obtain a copy of the Annual Report on Form 10-K? |

You may receive a hardcopyhard copy of proxy materials, including the Annual Report on Form 10-K, by following the directions set forth on the Notice Regarding the Availability of Proxy Materials. The Annual Report on Form 10-K is also available on our website at http://ir.hill-rom.com.

| 19. | Where can I find the voting results of the annual meeting? |

We will announce preliminary voting results at the conclusion of the annual meeting and publish the final voting results in a Form 8-K to be filed with the U.S. Securities and Exchange Commission (“SEC”) within four business days after the conclusion of the annual meeting.

PROPOSALS REQUIRING YOUR VOTEProposals Requiring Your Vote

|

Proposal No. 1 – Election of Directors

The Board currently consists of nine members, and the terms of all the directors expire at the upcoming annual meeting. As previously announced, one of our current directors, Joanne Smith, M.D., has decided not to seek reelection to the Board. The shareholders will therefore elect nine members of the Board to serve one-year terms expiring at the 20162017 annual meeting of shareholders. Unless authority is withheld, all shares represented by proxies submitted pursuant to this solicitation (other than broker non-votes) will be voted in favor of electing as directors the nominees listed below for the terms indicated. If any of these nominees should be unable to serve, shares represented by proxies may be voted for a substitute nominee selected by the Board, or the position may become vacant.

The Board of Directors recommends that shareholders vote “FOR”FOR” the election to the Board of Directors of each of the nominees named below.

NOMINEES

| Name | Age | Principal Occupation | Director Since | Age | Principal Occupation | Director Since |

| Rolf A. Classon | 69 | Chairman of the Board of Hill-Rom | 2002 | 70 | Chairman of the Board of Hill-Rom | 2002 |

| John J. Greisch | 59 | President and Chief Executive Officer of Hill-Rom | 2010 | 60 | President and Chief Executive Officer of Hill-Rom | 2010 |

| William G. Dempsey | 63 | Retired Executive Vice President, Global Pharmaceuticals, Abbott Laboratories | 2014 | 64 | Retired Executive Vice President, Global Pharmaceuticals, Abbott Laboratories | 2014 |

| James R. Giertz | 57 | Senior Vice President and Chief Financial Officer of H.B. Fuller Company | 2009 | 58 | Executive Vice President and Chief Financial Officer of H.B. Fuller Company | 2009 |

| Charles E. Golden | 68 | Retired Executive Vice President and Chief Financial Officer of Eli Lilly and Company | 2002 | 69 | Retired Executive Vice President and Chief Financial Officer of Eli Lilly and Company | 2002 |

William H. Kucheman | 65 | Former Interim Chief Executive Officer of Boston Scientific Corp. | 2013 | 66 | Former Interim Chief Executive Officer of Boston Scientific Corp. | 2013 |

| Ronald A. Malone | 60 | Retired Chief Executive Officer of Gentiva Health Services, Inc. | 2007 | 61 | Retired Chief Executive Officer of Gentiva Health Services, Inc. | 2007 |

| Eduardo R. Menascé | 69 | Retired President, Enterprise Solutions Group, Verizon Communications | 2004 | 70 | Retired President, Enterprise Solutions Group, Verizon Communications | 2004 |

| Stacy Enxing Seng | 50 | Former President, Vascular Therapies, Covidien | New Nominee | 51 | Former President, Vascular Therapies, Covidien | 2015 |

ROLF A. CLASSON

Mr. Classon became Chairman of the Board of Hill-Rom in 2006. He served as Interim President and Chief Executive Officer of Hill-Rom from May 2005 until March 2006 and as Vice Chairman of the Board from December 2003 until his election as Interim President and Chief Executive Officer. From 2002 to 2004, Mr. Classon served as Chairman of the Executive Committee of Bayer Healthcare AG, the healthcare division of Bayer AG, a global healthcare and chemicals company, and, from 1995 to 2002, Mr. Classon served as President of Bayer Diagnostics. From 1991 to 1995, Mr. Classon was an Executive Vice President in charge of Bayer Diagnostics’ Worldwide Marketing, Sales and Service operations. From 1990 to 1991, Mr. Classon was President and Chief Operating Officer of Pharmacia Biosystems A.B. Prior to 1990, Mr. Classon served as President of Pharmacia Development Company Inc. and Pharmacia A.B.’s Hospital Products Division. Mr. Classon currently serves as a director of Auxilium Pharmaceuticals, Inc. (through January 2015), Fresenius Medical Care, Tecan Group and Catalent, Inc., and wasserved as a director of Millipore Corporation until 2010.Auxilium Pharmaceuticals, Inc. through 2015.

Mr. Classon has extensive experience in the health care industry, including positions in management and on the boards of several companies. His service as a senior officer in numerous international corporations brings an extensive breadth of knowledge and valuable insight to the Board.

JOHN J. GREISCH

Mr. Greisch was elected President & Chief Executive Officer of Hill-Rom effective January 8, 2010. Mr. Greisch was most recently President International Operations for Baxter International, Inc., a position he held since 2006. During his seven year tenure with Baxter, he also served as Baxter's Chief Financial Officer and as President of Baxter's BioScience division. Before his time with Baxter, he was President & CEO for FleetPride Corporation in Deerfield, Ill., an independent after-market distribution company serving the transportation industry. Prior to his tenure at FleetPride, he held various positions at The Interlake Corporation in Lisle, Ill., a leading global engineered materials and industrial equipment supplier, including serving as President of the company's Materials Handling Group. Mr. Greisch currently serves on the Board of Directors for Actelion Ltd, and AdvaMed. Additionally, he is on the Board of Directors for Ann & Robert H. Lurie Children's Hospital of Chicago. Through 2010, Mr. Greisch served as a director of TomoTherapy, Inc.

As the CEO of Hill-Rom, Mr. Greisch brings valuable multinational experience with multiple roles in a major public healthcare company, including as Chief Financial Officer, as well as operational insights and business knowledge to the Board.

WILLIAM G. DEMPSEY

Mr.William Dempsey has served as a director of Hill-Rom since 2014. Mr. Dempsey previously held various executive positions with Abbott Laboratories from 1982 until 2007, including, Executive Vice President of Global Pharmaceuticals from 2006, Senior Vice President of Pharmaceutical Operations from 2003 and Senior Vice President of International Operations from 1999. He currently serves as a director of Landauer Inc. and Hospira, Inc., and was on the board of Nordion, Inc. through 2014.2014 and Hospira, Inc., through 2015. He has previously served as Chairman of the International Section of the Pharmaceutical Research and Manufacturers of America (PhRMA) and as Chairman of the Accelerating Access Initiative a cooperative public-private partnership of UNAIDS, the World Bank, and six research-based pharmaceutical companies. He is a member of the Salvation Army Advisory Board in Chicago and the Board of Trustees for the Guadalupe Center in Immokalee, Florida.

Mr. Dempsey has extensive experience in the health care industry, including positions in management and on the boards of several companies. In addition, his international operations experience and his service as a senior officer at a large company makes him highly qualified to serve on the Board.board.

JAMES R. GIERTZ

Mr. Giertz has served as a director of Hill-Rom since 2009. He has been Executive Vice President and Chief Financial Officer of H.B. Fuller Company, St. Paul, Minnesota, since March 2008. Prior to joining H.B. Fuller, he served as Senior Managing Director, Chief Financial Officer and, for several months in 2007 a director, of Residential Capital, LLC, one of the largest originators, servicers and securitizers of home loans in the United States. Prior to that, he was Senior Vice President of the Industrial Products division, and Chief Financial Officer of Donaldson Company, Inc., a worldwide provider of filtration systems and replacement parts. In addition, Mr. Giertz served as assistant treasurer of the parent company at General Motors, and also held several international treasury positions in Canada and Europe. Mr. Giertz also serves on the Board of the Junior Achievement of the Upper Midwest and the Board of Regents of Concordia University of St. Paul.

Mr. Giertz has extensive experience in financial statement preparation and accounting, and operations, and his service as a senior officer in large corporations brings knowledge and valuable insight to the Board. In addition, his international experience is a valuable asset to the Board.

CHARLES E. GOLDEN

Mr. Golden has served as director of Hill-Rom since 2002. He served as Executive Vice President and Chief Financial Officer and a director of Eli Lilly and Company, an international developer, manufacturer and seller of pharmaceutical products, from 1996 until his retirement in 2006. Prior to joining Eli Lilly, he had been associated with General Motors Corporation since 1970, where he held a number of positions, including Corporate Vice President, Chairman and Managing Director of the Vauxhall Motors subsidiary and Corporate Treasurer. He is currently on the board of Eaton Corporation PLC, and was formerly on the boards of Unilever NV/PLC through 2014. He also serves as a director of the Lilly Endowment and Indiana University Health.

Mr. Golden has a comprehensive knowledge of both U.S. GAAP and IFRS, has extensive experience in financial statement preparation, accounting, corporate finance, risk management and investor relations both in the U.S. and Europe. His significant financial healthcare experience brings valuable financial and operations rigor and insight to the Board.

WILLIAM H. KUCHEMAN

Mr. Kucheman has served as a director of Hill-Rom since 2013. He previously served as interim Chief Executive Officer for Boston Scientific Corp. Before being named interim CEO in October 2011, he was Executive Vice President and President of the Cardiology, Rhythm and Vascular (CRV) Group of Boston Scientific. He joined the Company in 1995 as a result of Boston Scientific’s acquisition of SCIMED Life Systems, Inc., becoming Senior Vice President of Marketing. In this role, Mr. Kucheman was responsible for global marketing. He has served on several industry boards, including the board of directors of the Global Health Exchange and on the boards of several non-public companies.

Mr. Kucheman’s executive experience with invasive medical devices, including FDA regulation, commercialization process, government reimbursement, and clinical marketing, makes him highly qualified to serve on the Board.

RONALD A. MALONE

Mr. Malone has served as a director of Hill-Rom since 2007. He served as Chairman of the Board of Gentiva Health Services from 2002 to 2011, as Chief Executive Officer from 2002 through 2008, and as a director through 2012. He joined Gentiva in 2000 as Executive Vice President and President of Gentiva’s Home Health Division. Prior to joining Gentiva, he served in various positions with Olsten Corporation including Executive Vice President of Olsten Corporation and President, Olsten Staffing Services, United States and Canada. He is a director of Capital Senior Living, Inc., a former director of the National Association for Home Care & Hospice and a former director and chairman of the Alliance for Home Health Quality and Innovation.

Mr. Malone has an intimate knowledge of the home health industry and expertise in the legislative and regulatory landscape affecting healthcare companies. In addition, his experience as an officer of other health care companies provides the Board with valuable operational experience.

EDUARDO R. MENASCÉ

Mr. Menascé has served as a director of Hill-Rom since 2004. He is the retired President of the Enterprise Solutions Group for Verizon Communications, Inc. Prior to Verizon, he was the President and Chief Executive Officer of CTI MOVIL S.A. (Argentina), a business unit of GTE Corporation, from 1996 to 2000, and also held senior positions at CANTV in Venezuela, Wagner Lockheed and Alcatel in Brazil, and GTE Lighting in France. Mr. Menascé currently serves on the Boards of Directors of Pitney Bowes Inc., John Wiley & Sons, Inc. and Hillenbrand, Inc., and formerly served on the board of KeyCorp. Mr. Menascé is a Co-Chairman of The Taylor Companies, a privately held global investment bank which specializes exclusively in mergers, acquisitions and divestitures. He is also a member of the Board of Directors of Daybreak, a non-profit charitable organization focused on funding research for rare genetic diseases.

Mr. Menascé has broad experience as a former senior executive responsible for a significant international operation of a public company. This operational experience and his experience on other public company boards all provide the Board with valuable insight.

STACY ENXING SENG

Ms. Enxing Seng is a new nominee to the Board. She most recentlyhas served as andirector of Hill-Rom since 2015. She is the former President, Peripheral Vascular of Covidien from 2012 to 2014, and Executive in Residence for Covidien as well asin 2014. Prior to that, she was President, of Covidien’s Vascular Therapies, Division from 2012 to 2014, and President of Peripheral VascularCovidien from 2010 to 2012. Ms. Enxing Seng joined Covidien in 2010 through the $2.6B acquisition of ev3 Incorporated, where she was a founding member and executive officer responsible for leading ev3’stheir Peripheral Vascular division from 2001 to 2010. Prior to that, she held positions of increasing responsibility with SCIMED, Boston Scientific, American Hospital Supply and Baxter. SheMs. Enxing Seng currently serves on the boards of Sonova Holding AG, Solace Therapeutics, and Spirox, Inc., and was formerly on the boards of FIRE 1 Medical Incubator and CV Ingenuity.

Ms. Enxing Seng has broad experience as a former senior executive responsible for a world-wide business unit of a major medical device company. In addition, she has significant experience as a co-founder of a successful medical device start-up. Her operational experience at a large medical device company, combined with her broad scope experience gained from her role as a co-founder of a medical device company, provide the Board with valuable insights inacross marketing, sales, innovation and a variety of marketing, sales and other medical device related areas.

Proposal No. 2 – Non-bindingNon-Binding Vote on Executive Compensation

We hold an annual non-binding vote on Executive Compensation each year. Last year, the shareholders approved this resolution on executive compensation with over 98% of shares (excluding abstentions and broker non-votes) being cast in favor of our executive compensation.Accordingly, we are presenting to our shareholders the following resolution for their annual vote (on a non-binding basis) on the following resolution::

“RESOLVED, that the shareholders of Hill-Rom Holdings, Inc. approve, on an advisory basis, the compensation of the Company’s named executive officers and the overall compensation policies and procedures employed by Hill-Rom, disclosed pursuant to Item 402 of Regulation S-K, and described in the Compensation Discussion and Analysis and the tabular disclosure regarding named executive officer compensation (together with the accompanying narrative disclosure) in this proxy statement.”

As described under “Compensation Discussion and Analysis” beginning on page 22,31, our philosophy in setting executive compensation is to provide a total compensation package that allows us to continue to attract, retain and motivate talented executives who drive our Company’s success, while aligning compensation with the interests of our shareholders and ensuring accountability and transparency. Consistent with the philosophy, a significant majority of the total compensation opportunity for each of our named executive officers is based on measurable corporate, business area and individual performance, both financial and non-financial, and on the performance of our shares on a long-term basis.

Because your vote is advisory, it will not be binding on the Board of Directors. However, the Compensation and Management Development Committee (the “Compensation Committee”) will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors recommends that you vote “FOR” the approval of this resolution.

Proposal No. 3 – Non-Binding Vote on Frequency of Shareholder Vote on Executive Compensation

In addition to providing shareholders with the opportunity to cast a non-binding advisory vote on executive compensation, Section 14A of the Securities Exchange Act of 1934 requires that the Company not less frequently than every 6 years provide shareholders with an advisory vote on whether the advisory vote on executive compensation should be held every one, two or three years.

The last such vote occurred at the 2011 Annual Meeting of Shareholders. We are presenting to our shareholders the following resolution for their vote (on a non-binding basis):

“RESOLVED, that the shareholders of the Company determine, on an advisory basis, that the frequency with which the shareholders of the Company shall have an advisory vote on the compensation of the Company’s Named Executive Officers set forth in the Company’s proxy statement is:

Choice 1 – every one year;

Choice 2 – every two years;

Choice 3 – every three years; or

Choice 4 – abstain from voting.”

The Board continues to believe that a frequency of “every year” for the non-binding advisory vote on executive compensation is the most appropriate and in the best interests of the Company’s shareholders.

Although this advisory vote on the frequency of the vote on executive compensation is non-binding, the Board and the Nominating/Corporate Governance Committee will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

The Board of Directors recommends that you vote “Choice 1 – every one year” for the frequency of the non-binding advisory shareholder vote on executive compensation.

Proposal No. 34 – Reauthorization of the Hill-Rom Holdings, Inc. Short-Term Incentive Compensation Plan

The Hill-Rom Holdings, Inc. Short-Term Incentive Compensation Plan (the “STIC Plan”) provides for awards to officers of Hill-Rom which are based on the attainment of specified performance goals or objectives. The STIC Plan was originally approved by the shareholders at our 2011 annual meeting. Hill-Rom is requesting reauthorization of the STIC Plan so that awards under the STIC Plan will continue to be considered “performance-based” under Section 162(m) of the Internal Revenue Code.

Section 162(m) generally precludes a publicly traded company from taking a tax deduction for compensation in excess of $1 million paid to certain executives. These executives are the company’s chief executive officer and the three other most highly paid executives, other than the chief financial officer. This restriction is subject to an exception for “performance-based” compensation that meets certain requirements, including a requirement that the “material terms of the performance goals” applicable to these named executive officers must be disclosed to and approved by shareholders before any compensation is paid to them. Shareholders last approved the STIC Plan, including the material terms of the performance goals, at the 2011 annual meeting. Section 162(m) requires that if the targets under the performance goals can be changed, the material terms of the performance goals must be reapproved by shareholders every five years in order to retain qualification under Section 162(m).

The material terms of the performance goals that must be approved for purposes of Section 162(m) include: (i) the individuals eligible to receive the compensation; (ii) a description of the business criteria on which the performance goals are based; and (iii) the maximum amount of compensation that can be paid to an individual under the performance goals. Each of these material terms is described below.

The following is a summary of the material features of the STIC Plan.

Purpose

The purposes of the STIC Plan are to:

| · | provide us flexibility to attract, motivate and retain the services of participants who make significant contributions to our success, and to allow participants to share in our success; |

| · | optimize our profitability and growth through incentives which are consistent with our goals and which link the performance objectives of participants to those of our shareholders; and |

| · | provide participants with an incentive for excellence in individual performance. |

Eligibility

Officers of Hill-Rom are eligible to participate in the STIC Plan. The Compensation and Management Development Committee is empowered to determine the specific participants in the STIC Plan, and has designated the members of our executive leadership team, including our continuing Named Executive Officers, as participants in the STIC Plan for our 2016 fiscal year.

Administration

The STIC Plan is administered by the Compensation and Management Development Committee, which has sole responsibility for determining the participants, establishing performance objectives, setting award targets and determining award amounts, as allowed by the STIC Plan.

Performance Objectives

The STIC Plan’s performance objectives are determined with reference to “EBITDA”, as such term is specifically defined in the STIC Plan. The STIC Plan defines “EBITDA” to mean, for each relevant fiscal year (the “Performance Period”), Hill-Rom’s earnings before interest, taxes, depreciation and amortization as reported in Hill-Rom’s audited consolidated financial statements for the Performance Period, with such adjustments for such Performance Period as the Compensation and Management Development Committee may provide for prior to the commencement thereof, or at such later time as may be permitted by applicable provisions of the Internal Revenue Code (which adjustments may include effects of charges for restructurings, discontinued operations, extraordinary items, other unusual or non-recurring items, and the cumulative effect of tax or accounting changes, each as identified in the financial statements, notes to the financial statements or management’s discussion and analysis).

Awards

The maximum amount payable for any fiscal year is:

*Chief Executive Officer: 2% of as-adjusted EBITDA for the Performance Period

*Other Officers: 1% of as-adjusted EBITDA for the Performance Period

When making awards to participants under the STIC Plan, the Compensation and Management Development Committee has the discretion to reduce, but not increase, such awards. The Compensation and Management Development Committee expects to continue to take into account the same metrics used to make awards under the STIC Plan in previous years when exercising such discretion, and that target payouts will remain unchanged from fiscal year 2015 for our Named Executive Officers. See “Executive Compensation” for additional details on these metrics.

Amendment or Modification

Our Board may modify, amend, suspend or terminate the STIC Plan, provided that no amendment that would require the consent of the shareholders of Hill-Rom pursuant to Section 162(m) of the Internal Revenue Code, New York Stock Exchange listing rules or the Securities Exchange Act of 1934, or any other applicable law, rule or regulation, shall be effective without such consent. However, no modification may, without the consent of the participant, reduce the right of a participant to a payment or distribution to which the participant is entitled by reason of an outstanding award allocation.

Should the shareholders not reauthorize the STIC Plan, no awards will be made under the STIC Plan for the 2016 fiscal year. In such case, however, the Compensation and Management Development Committee will consider other alternatives.

The Board of Directors recommends that you vote “FOR” the reauthorization of the Hill-Rom Holdings, Inc. Short-Term Incentive Plan.

Proposal No. 5 – Reauthorization of the Hill-Rom Holdings, Inc. Stock Incentive Plan

The Hill-Rom Holdings, Inc. Stock Incentive Plan (the “Stock Incentive Plan”) provides for awards relating to the Company’s common stock to employees, officers and directors of Hill-Rom. Awards may be in the form of stock options, stock appreciation rights, restricted stock, deferred stock or bonus stock. The Stock Incentive Plan was originally approved by the stockholders at our 2002 annual meeting, and an amendment to the Stock Incentive Plan was approved at our 2009 annual meeting. Hill-Rom is requesting reauthorization of the Stock Incentive Plan so that certain awards under the Stock Incentive Plan will continue to be considered “performance-based” under Section 162(m) of the Internal Revenue Code. Hill-Rom is not proposing any changes to the Stock Incentive Plan, nor is Hill-Rom proposing to increase the shares authorized by the plan.

As explained under Proposal No. 4 above, Section 162(m) generally precludes a publicly traded company from taking a tax deduction for compensation in excess of $1 million paid to certain executives but provides an exception for “performance-based” compensation that meets certain requirements, including a requirement that the “material terms of the performance goals” applicable to these named executive officers must be disclosed to and approved by shareholders before any compensation is paid to them. Shareholders last approved an amendment to the Stock Incentive Plan at the 2009 annual meeting.

The material terms of the performance goals that must be approved for purposes of Section 162(m) include: (i) the individuals eligible to receive the compensation; (ii) a description of the business criteria on which the performance goals are based; and (iii) the maximum amount of compensation that can be paid to an individual under the performance goals. Each of these material terms is described below.

The following is a summary of the material features of the Stock Incentive Plan.

Shares

Shares awarded under the Stock Incentive Plan may be authorized but unissued shares or shares that have been issued and reacquired by the Company. The exercise of a stock appreciation right for cash or the payment of any award in cash shall not count against the Stock Incentive Plan’s share limit. To the extent a stock option is surrendered for cash or terminates without having been exercised, or an award terminates without the holder having received payment of the award, or shares awarded are forfeited, the shares subject to such award will be available for future awards under the Stock Incentive Plan. In addition, shares surrendered to the Company in payment of the option price or withheld by the Company to satisfy the award holder’s tax liability with respect to an award will count against the share limit.

Administration

The Stock Incentive Plan is administered with respect to awards to employees by either the full Board or a committee of the Board, and with respect to awards to non-employee directors, by the full Board. (The Board or Committee so acting is referred to in this description as the “Administrator.”) The Administrator is authorized to, among other things, grant and set the terms of awards under the Stock Incentive Plan; amend such awards (other than in a manner that would constitute a repricing); waive compliance with the terms of such awards; interpret the terms and provisions of the Stock Incentive Plan and awards granted under it; adopt administrative rules and practices governing the Stock Incentive Plan; and make all factual and other determinations needed for administration of the Stock Incentive Plan. The terms of an award under the Stock Incentive Plan may vary from participant to participant.

Eligibility

Awards under the Stock Incentive Plan may be made by the Administrator, in its discretion, to all employees, officers, and directors of the Company and of any entity which is more than 50% owned, directly or indirectly, by the Company. As a result of such eligibility, each executive officer and director has an interest in the proposal to approve the amendment of the Stock Incentive Plan. Awards may also be made to prospective employees, officers, and directors, to become effective only upon their commencement of employment or service. Generally, awards under the Stock Incentive Plan are made only to senior employees, of whom there were approximately 130 as of the record date, and to non-employee directors, of whom there were 8 as of the record date. However, awards also can be made under the plan to other employees, of whom there were approximately 10,000 as of the record date. Award recipients are selected by the Administrator, in its sole discretion, from among those eligible. Under the Stock Incentive Plan, as amended, the maximum number of shares which may be subject to awards granted to an employee in any fiscal year will be 500,000 shares of common stock with respect to the aggregate of stock options and stock appreciation rights, and an additional 250,000 shares with respect to the aggregate of restricted stock, deferred stock, and bonus stock awards.

Discretionary Awards

The Stock Incentive Plan authorizes the Administrator to grant awards to employees, including officers, and non-employee directors on such terms as it may determine in its sole discretion. Awards may be granted alone or in tandem with other types of awards under the Stock Incentive Plan. A summary of the types of awards available under the Stock Incentive Plan is set forth below.

1. Stock Options. Incentive stock options (“ISOs”) and non-qualified stock options may be granted for such number of shares of common stock as the Administrator determines. A stock option will be exercisable and vest at such times, over such term and subject to such terms and conditions as the Administrator determines, at an exercise price determined by the Administrator (ISOs are subject to restrictions as to exercise period and price as required by the Internal Revenue Code and may be granted only to employees). Payment of the exercise price may be made in such manner as the Administrator may provide, including cash, delivery of shares of common stock already owned, broker-assisted “cashless exercise,” or any other manner determined by the Administrator. The Administrator may provide that the stock options will be transferable. Upon an optionee’s termination of service, the option will be exercisable to the extent determined by the Administrator, either in the initial grant or an amendment thereto. The Administrator may provide that an option which is outstanding on the date of an optionee’s death will remain outstanding for an additional period after the date of such death, notwithstanding that such option would have expired earlier under its terms.

2. Stock Appreciation Rights (“SARs”). Upon the exercise of a SAR, the Company will pay to the holder in cash, common stock or a combination thereof (the method of payment to be at the discretion of the Administrator), an amount equal to the excess of the fair market value of the common stock on the exercise date over the fair market value of the common stock on the date of SAR grant, multiplied by the number of SARs being exercised. The Administrator may also grant “limited SARs” that will be exercisable only within the 60 days after a “Change in Control” of the Company (as defined in the Plan). The Administrator may provide that in the event of a Change in Control, SARs or limited SARs will be paid on the basis of the “Change in Control Price” (as defined in the Plan).

3. Restricted Stock. Restricted stock is stock which has been issued, subject to forfeiture. In making an award of restricted stock, the Administrator will determine the periods, if any, during which the stock is subject to forfeiture, and the purchase price, if any, for the stock. The vesting of restricted stock (i.e., the point at which it becomes non-forfeitable) may be conditioned upon the completion of a specified period of service with the Company or a subsidiary, the attainment of specific performance goals, or such other criteria as the Administrator may determine. During the restricted period, the award holder may not sell, transfer, pledge or assign the restricted stock, except as may be permitted by the Administrator. The certificate evidencing the restricted stock will be registered in the holder’s name, although the Administrator may direct that it remain in the possession of the Company until the restrictions have lapsed. Except as may otherwise be provided by the Administrator, upon the termination of the award holder’s service for any reason during the period before the restricted stock has vested, or in the event the conditions to vesting are not satisfied, all restricted stock that has not vested will be forfeited and the Administrator may provide that any purchase price paid by the holder, or an amount equal to the restricted stock’s fair market value on the date of forfeiture, if lower, shall be paid to the holder. During the restricted period, the holder will have the right to vote the restricted stock and to receive any cash dividends, if so provided by the Administrator. Stock dividends will be treated as additional shares of restricted stock and will be subject to the same terms and conditions as the initial grant, unless otherwise provided by the Administrator.

4. Deferred Stock. A deferred stock award represents the Company’s agreement to deliver shares of common stock (or their cash equivalent) at a specified future time. Such delivery may be conditioned upon the completion of a specified period of service, the attainment of specific performance goals or such other criteria as the Administrator may determine, or may provide for the unconditional delivery of shares (or their cash equivalent) on the specified date. In making an award of deferred stock the Administrator will determine the period during which receipt of the common stock will be deferred, and the period, if any, during which the award is subject to forfeiture, and may provide for the issuance of stock pursuant to the award without payment therefor. At the end of the deferral period, and assuming the satisfaction of any condition(s) to vesting of the award, the award will be settled in shares of common stock, cash equal to the fair market value of such stock, or a combination thereof, as provided by the Administrator. During the deferral period set by the Administrator, the award holder may not sell, transfer, pledge or assign the deferred stock award. In the event of termination of service before the deferred stock award has vested, the award will be forfeited, except as may be provided by the Administrator. Deferred stock will carry no voting rights until such time as shares of common stock are actually issued. The Administrator has the right to determine whether and when dividend equivalents will be paid with respect to a deferred stock award.

5. Bonus Stock. A bonus stock award is a grant of stock to the recipient without payment of money, or the sale of stock at a discounted price. The Administrator may condition the award of bonus stock upon the attainment of specified performance objectives or upon such other criteria as the Administrator may determine. However, once the shares are issued, they are not subject to vesting conditions.

Performance Awards

The Administrator may designate any awards under the Stock Incentive Plan as “Performance Awards” which are intended to be granted and administered in a manner which would qualify as “performance-based compensation” for purposes of Section 162(m) of the Internal Revenue Code. Either the granting or vesting of a Performance Award will be subject to the achievement of performance objectives specified by the Administrator. The performance objectives specified for a particular award may be based on one or more of the following criteria, which the Administrator may apply to the Company on a consolidated basis and/or to a business unit, and which the Administrator may use either as an absolute measure, as a measure of improvement relative to prior performance, or as a measure of comparable performance relative to a peer group of companies: sales, operating profits, operating profits before taxes, operating profits before interest expense and taxes, net earnings, earnings per share, return on equity, return on assets, return on invested capital, total shareholder return, cash flow, debt to equity ratio, market share, stock price, economic value added, and market value added.

Although the Administrator generally has the power to amend awards and to waive conditions to the vesting of awards, this power may be exercised with respect to Performance Awards only to the extent that it would not cause the award to fail to qualify under Section 162(m).

Deferrals of Awards

The Administrator may permit an award recipient to elect to defer receipt of any award for a specified period or until a specified event, upon such terms as are determined by the Administrator.

Change in Control Provisions. If there is a Change in Control of the Company, unless otherwise determined by the Administrator, all stock options and SARs which are not then exercisable will become fully exercisable and vested; the restrictions and vesting conditions applicable to restricted stock and deferred stock will lapse and such shares and awards will be deemed fully vested; and the Administrator, in its sole discretion, may accelerate the payment date of all restricted stock and deferred stock. Unless the Administrator provides otherwise, to the extent the cash payment of any award is based on the fair market value of common stock, such fair market value shall be the Change in Control Price. A “Change in Control” is defined in the Plan in the same manner as in the Change in Control Agreements with the named executive officers. (See “Executive Compensation — Compensation Discussion and Analysis” below.) The “Change in Control Price” is generally the highest price per share paid for the Company’s common stock in the open market or paid or offered in any transaction related to a Change in Control at any time during the 90-day period ending with the Change in Control.

Amendment

The Stock Incentive Plan is of unlimited duration. The Stock Incentive Plan may be discontinued or amended by the Board of Directors, except that no amendment or discontinuation may adversely affect any outstanding award without the holder’s written consent. Amendments may be made without shareholder approval except as required to satisfy stock exchange or regulatory requirements.

Adjustment

In the case of certain changes in the Company’s structure affecting the common stock such that the Board determines that an adjustment is appropriate, in order to prevent dilution or enlargement of benefits, the Board will, in a manner as it deems equitable, adjust any or all of the number of shares reserved under the Stock Incentive Plan, and the number of shares as to which awards can be granted to any individual in any fiscal year. In the case of certain changes in the Company’s structure affecting the common stock subject to an award outstanding under the Stock Incentive Plan, the Board will appropriately and equitably adjust the number and kind of shares or other securities subject to the Stock Incentive Plan or subject to awards then outstanding under the Stock Incentive Plan and the exercise prices so as to maintain the proportionate number of shares or other securities without changing the aggregate exercise price. In addition, upon certain corporate transactions the Board may, in its discretion, (1) accelerate the vesting and/or payment date of awards, (2) cash-out outstanding awards, (3) provide for the assumption of outstanding awards by a surviving or transferee company, (4) provide that in lieu of shares of Company common stock, the award recipient will be entitled to receive the consideration he would have received for such shares in the transaction (or the value of such consideration in cash), and/or (5) require stock options to be either exercised prior to the transaction or forfeited.

Certain Federal Income Tax Consequences

The following is a summary of certain federal income tax aspects of stock options which may be awarded under the Stock Incentive Plan based upon the laws in effect on the date hereof.

Non-Qualified Stock Options. No income is recognized by the optionee at the time a non-qualified option is granted. Upon exercise of the option, the optionee recognizes ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option price. At disposition of the shares, any appreciation after the date of exercise is treated as capital gain.

Incentive Stock Options. An optionee generally will not recognize income upon the exercise of an Incentive Stock Option during the period of his/her employment with the Company or one of its subsidiaries or within three months after termination of employment. (The optionee also will not recognize income upon the exercise of an Incentive Stock Option within 12 months after the optionee’s termination of employment by reason of permanent and total disability, or within the remaining term of the option following the optionee’s death). However, the “spread” between the fair market value of the shares at the time of exercise and the exercise price is includible in the calculation of alternative minimum taxable income for purposes of the alternative minimum tax. The exercise of an Incentive Stock Option after the expiration of the specified time periods results in such exercise being treated in the same manner as the exercise of a non-qualified stock option.

If the optionee holds the shares received throughout the “ISO holding period,” which is both the two-year period after the ISO was granted and the one-year period after the exercise of the ISO, the optionee will recognize capital gain or loss when he/she disposes of the shares. Such gain or loss will be measured by the difference between the exercise price and the amount received for the shares at the time of disposition. If the shares acquired upon exercise of an ISO are disposed of before the end of the ISO holding period, the disposition is a “disqualifying disposition” which causes the optionee to recognize ordinary income in an amount generally equal to the lesser of (i) the excess of the value of the shares on the option exercise date over the exercise price or (ii) the excess of the amount received upon disposition of the shares over the exercise price. Any excess of the amount received upon disposition of the shares over the value of the shares on the exercise date will be taxed to the optionee as capital gain.

Company Deductions. As a general rule, the Company or one of its subsidiaries will be entitled to a deduction for federal income tax purposes at the same time and in the same amount that an employee or director recognizes ordinary income from awards under the Stock Incentive Plan, to the extent such income is considered reasonable compensation under the Internal Revenue Code. The Company will not, however, be entitled to a deduction with respect to payments which are contingent upon a change in control if such payments are deemed to constitute “excess parachute payments” pursuant to Section 280G of the Internal Revenue Code and do not qualify as reasonable compensation pursuant to that Section; such payments will subject the recipients to a 20% excise tax. In addition, the Company will not be entitled to a deduction to the extent compensation in excess of $1 million is paid to an executive officer named in the proxy statement who was employed by the Company at year-end, unless the compensation qualifies as “performance based” under Section 162(m) of the Internal Revenue Code.

Should the shareholders not reauthorize the Stock Incentive Plan, no awards will be made under the Stock Incentive Plan for the 2016 fiscal year. In such case, however, the Compensation and Management Development Committee will consider other alternatives.

The Board of Directors recommends that you vote “FOR” the reauthorization of the Hill-Rom Holdings, Inc. Stock Incentive Plan.

Proposal No. 6 – Ratification of the Appointment of the Independent Registered Public Accounting Firm

Subject to shareholder ratification, the Audit Committee of our Board has appointed PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending September 30, 2015.2016. Representatives from PwC will be present at the annual meeting with an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

The Audit Committee has adopted a policy requiring that all services from the outside independent registered public accounting firm must be pre-approved by the Audit Committee or its delegate and has adopted guidelines that non-audit related services, should not exceed the total of audit and audit related fees. During fiscal 2014,2015, PwC’s fees for non-audit related services fell within these guidelines.

The following table presents fees for professional services rendered by PwC for the audit of our annual consolidated financial statements for the years ended September 30, 20132014 and 2014,2015, and fees billed for other services rendered by PwC during those periods.

| | | 2013 | | 2014 | | 2014 | | 2015 |

| Audit Fees (1) | | $2,628,580 | | $2,783,900 | | $2,783,900 | | $3,618,840 |

| Tax Fees (2) | | $943,800 | | $355,732 | |

| All Other Fees (3) | | $146,800 | | $146,800 | |

| Audit-Related Fees (2) | | | -- | | $6,100 |

| Tax Fees (3) | | | $355,732 | | $688,268 |

| All Other Fees (4) | | | $146,800 | | $122,000 |

| Total | | $3,719,180 | | $3,286,432 | | $3,286,432 | | $4,435,208 |

| 1) | Audit Fees were billed by PwC for professional services rendered for the integrated audit of our consolidated financial statements and our internal control over financial reporting, along with the review and audit of the application of new accounting pronouncements, SEC releases, acquisition accounting, statutory audits of European and other foreign entities, and accounting for unusual transactions. |

| 2) | Audit-Related Fees were billed by PwC for assurance and related services that are reasonably related to the performance of the audit or review of financial statements, including attestation services that are not required by statute or regulation. |

| 3) | Tax Fees were billed by PwC for professional services rendered for tax compliance, tax advice and tax planning. |

3)4) | All Other Fees were fees billed by PwC for all other products and services provided to us. |

The Board recommends that you vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as Hill-Rom’s independent registered public accounting firm.

Board Leadership

The Board is currently led by our non-executive independent Chair, Mr. Classon. The Board has determined that the leadership of the Board is best conducted by an independent Chair. This allows the Chair to provide overall leadership to the Board in its oversight function, while the Chief Executive Officer, Mr. Greisch, provides leadership with respect to the day-to-day management and operation of our business. We believe the separation of the offices allows Mr. Classon to focus on managing Board matters and allows Mr. Greisch to focus on managing our business. In addition, we believe the separation of the offices enhances the objectivity of the Board in its management oversight role.

Executive sessions (meetings of outside and independent directors without management present) are held regularly at the beginning and end of Board meetings, and, depending on directors’ desire, from time to time during Board and committee meetings. The Chair generally presides at executive sessions of non-management directors.

Board’s Role in Strategic Planning and Oversight of Risk Management

The Board is responsible for directing and overseeing the management of Hill-Rom’s business in the best interests of the shareholders and consistent with good corporate citizenship. The Board sets strategic direction and priorities for the Company, approves the selection of the senior management team and oversees and monitors risks and performance. At Board meetings during the year, members of senior management review their organizations and present their long-range strategic plans to the Board, and at the start of each fiscal year, the Board reviews and approves the Company’s operating plan and budget for the next year.

A fundamental part of setting Hill-Rom’s business strategy is the assessment of the risks Hill-Rom faces and how they are managed. Senior management meets regularly meets to review and discuss the Company’s top enterprise risks. The output of these meetings is provided and discussed at each Board meeting. In addition, the Board, the Nominating/Corporate Governance, and the Audit Committees meet regularly throughout the year with our financial and treasury management teams and with our Chief Compliance Officer, Vice President, Internal Audit and Chief Legal Officer to assess the financial, legal, compliance, and operational/strategic risks throughout our businesses and review our insurance and other risk management programs and policies. These regular meetings enable the Board to exercise its ultimate oversight responsibility for Hill-Rom’s risk management processes.

In addition, the Compensation and Management Development Committee assesses Hill-Rom’s compensation structure on a regular basis to appropriately align risks and incentives for our executive management. See “Compensation Discussion and Analysis” at page 31 for additional information.

Communications with Directors

Shareholders of Hill-Rom and other interested persons may communicate with the Chair of the Board, the chairs of Hill-Rom’s committees of the Board, or the non-management directors of Hill-Rom as a group by sending an email to investors@hill-rom.com. The email should specify the intended recipient.